Gold Investment Agency

Gold Investment Agency

History of Gold

Gold has always fascinated people. Gold is a popular precious metal in all the countries around the world.

Since ancient times, gold has played an important role in the societies. That times, many gold ornaments were made for religious ceremonies and to show the power of kings. The three great golden masks of Egypt, for example, are famous.

In the 19th century, there was a gold rush in the United States and Australia, where veins of gold were discovered and many miners rushed to find them.

Even in Japan, gold was used as "money" as part of our lives. Gold trading began in the Muromachi period (1336-1573), and gold seals were cast in the Azuchi-Momoyama period (1573-1573). Gold coins and large and small coins continued to be used until the 20th century. Even after the development of paper money, the gold standard, an economic system that guaranteed the exchange of paper money for gold, was applied until the Meiji era. During the Taisho era (1912-1926), this gold standard was abolished, so gold was managed as a real asset.

“Gold" has been advancing with our human civilization.

Types of Gold

The notation "Karat" is used to describe gold, where Karat stands for purity. The purity of gold is expressed in 24 fractions. This means that pure gold is 24Karat. The higher purity makes it more expensive, but the higher hardness makes it soft and vulnerable to heat, which causes it to lose its shape and be easily scratched.

Gold products in the Japanese market are often one of the five main types; 24k gold, 22k gold, 18k gold, 14k gold or 10k gold. In Thailand, 23-karat gold (96.5% purity) is most commonly sold.

24k gold (99.99% purity)

As it is almost 100% pure gold, it will not rust or tarnish. However, due to its softness, it is not suitable for accessories, and is mainly processed into ingots, coins, and other products that are intended to have asset value.

23k Gold (96.5% purity)

This purity is not available in Japan, but K23 gold is the most common gold in Thailand. It is processed into ingots and accessories.

22k gold (91.7% purity)

In recent years, it has begun to attract worldwide attention and is mainly used for accessories.

18k gold (75% purity)

It is used for accessories because of its hardness and ease of processing. It is also used in various other applications such as watches and cameras. In Japan, this 18-karat gold is mainly used.

14k gold (58.5% purity)

The price is relatively low due to the high percentage of mixtures. It is mainly processed into accessories and pens.

10k gold (42% purity)

Because the proportion of the mixture outweighs of gold, the shine is weak and prone to rusting.

The world standard for internationally traded gold is 24k gold (99.99% purity).

We only deal in 99.99% purity ingots.

The Attractiveness and Value of Gold

1 Scarcity

Since gold is a mineral, its reserves are limited and it is a rare resource. It is estimated that about 180,000 tons of gold have been mined to date, the equivalent of 3.7 official Olympic swimming pools. It is estimated that there are about 50,000 tons of reserves left in the earth, most of which are in difficult-to-mineralize locations.

2 Universal Values

Gold itself has universal value and will never be worthless. Stocks, bonds and banknotes are based on the credit of the issuing company or nation, so there is a credit risk for the issuer and they may become worthless at times. However, gold has no credit risk because there is no issuer, and it has never been worth zero because gold can be valued anywhere in the world. While gold is a "material", it continues to have universal value as "world class currency". The gold is therefore held as a reserve for payment at the central banks of major governments.

3 Quality will not deteriorate

High purity gold will not rust or decay and will retain its luster forever. It is highly durable and does not deteriorate in quality.

4 Resistant to inflation and deflation

Gold is a universal physical asset that is ideal for long-term wealth preservation. Therefore, people choose to replace physical gold as a hedge against inflation. When inflation diminishes the value of money, the price of gold rises, and when deflation causes credit concerns, gold is supported as a physical asset, so the price of gold remains stable.

5 The possibility of transaction anywhere in the world

Gold has long been considered a universal currency and asset and can be converted to cash anywhere in the world. Gold is traded on gold markets around the world and has a fair price.

6 Strong in case of emergency

When the political and economic outlook is unstable due to a military contingency such as war or terrorism, or a pandemic such as Corona, stocks, bonds, and currencies will fall, while assets will increasingly convert to gold, which is recognized as a common global asset. In fact, during the past 2008 financial crisis, 1973-74 oil crisis, the price of gold skyrocketed.

7 Near-liquid asset

Unlike real estate assets, gold can be turned into cash quickly and carried with you when you need it.

Gold Asset for the “Balanced Portfolio”

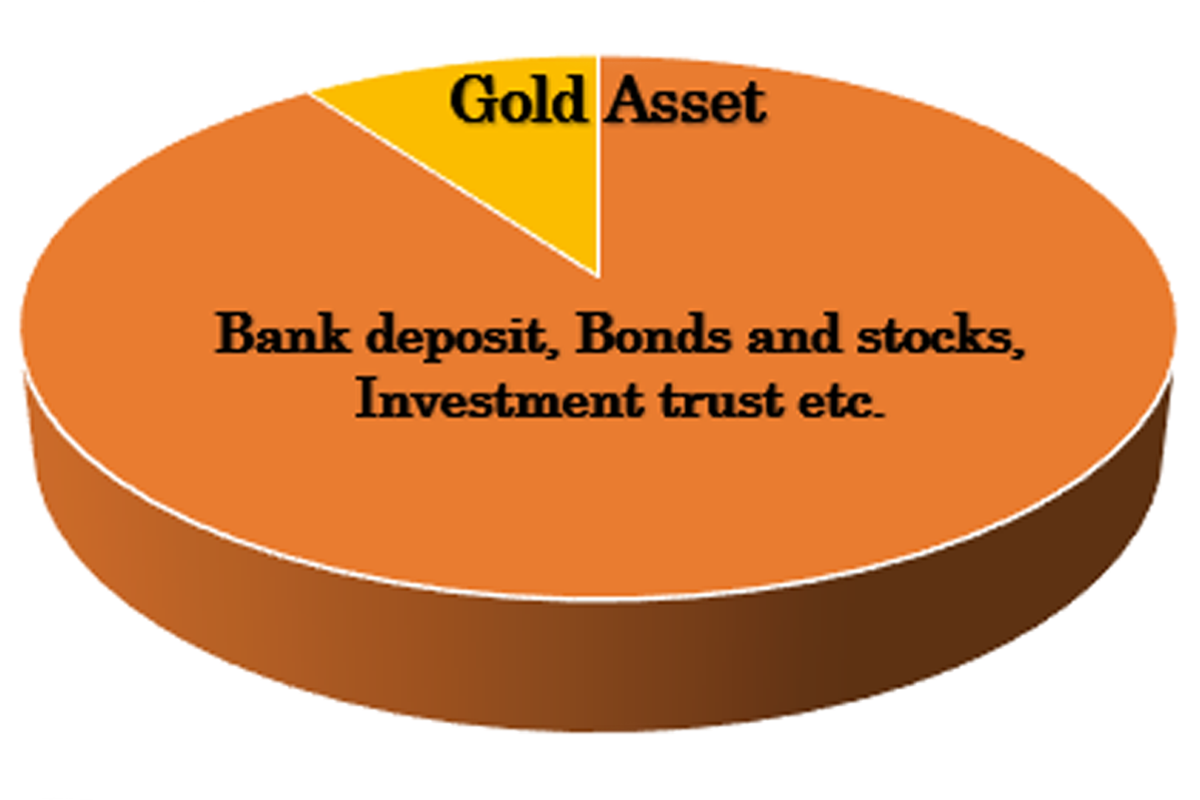

One of the major goals of asset management is to diversify risks.

Most people possess their asset in the form of bank deposits, insurance and pensions. But bank deposits and insurance are vulnerable to inflation, and bonds and stocks have the risk of being just a piece of paper, if the issuer lost its credit. In order to increase the effectiveness of risk diversification, a balanced and effective asset management approach must be adopted. It is very important to have assets which are flexible to deal with unknown future situation.

Gold is known as a physical asset, and it maintains a stable value over the long term. By incorporating gold asset into your own portfolio, you can reduce the credit risk of your deposits, bonds and stocks. And since the price of gold is said to be inversely correlated with stock prices, it can be effective to include gold asset as a means of hedging risk.

Generally speaking, the ideal balance of gold asset is considered to be 10% of all assets

Benefits of investing in Gold

Investment to Gold has the advantage that it can be sold at any time and the price is stable. On the other hand, savings at banks are not absolutely safe as a means of asset protection, considering the possibilities of decrease in value due to inflation. In addition, while bonds and stocks are expected to be profitable, there is a risk that they will become pieces of paper if the credit of the issuer is lost.

Gold asset is said to be highly stable even in the times of sudden changes in stocks, currencies exchange rates, and the price of gold remained stable even when global stock markets fell at the 2008 Lehman Shock, the 2015 China Shock and even the 2020 Corona Pandemic.

Contingency "money"

The world continues to be unstable. One of the most secure assets to hold in such times is and always has been gold.

Why Thailand?

In order to diversify and protect your valuable assets, we recommend to possess gold asset in Thailand.

1. Selling prices in Thailand are often lower than in Japan.

Gold is traded in baht (1 baht = 15.244g) in Thailand. If you convert the retail price in Thailand into Japanese yen/grams, it is often cheaper than the retail price in Japan. There is no tax on buying or selling gold in Thailand. For more information, please click here. (Link to Japan-Thailand Gold Price Comparison)

2. Diversification of assets (variety of products in various countries)

Thailand has a good legal, trading and storage system in place because of the country's inherently active gold trade. Also, natural disasters such as earthquakes and typhoons, which have a high probability of occurring in Japan, are not common in Thailand. As a form of asset management, gold asset is an effective way of the possession of assets.

3. Low geopolitical risk and security

In Japan, geopolitical risks are high due to missile launches and nuclear tests from North Korea, and the country is constantly unstable. Thailand, on the other hand, has maintained a stable relationship with its neighbors and other countries, maintaining a balance between the two countries while emphasizing cooperation and collaboration. The construction of an East-West Economic Corridor linking the South China Sea and the Indian Ocean and a North-South Economic Corridor from China across the Indochina Peninsula are currently underway.

4. Thailand has never been a colony

Thailand is said to be the only country in Southeast Asia that did not become a colony. Vietnam is a French colony, and Myanmar is a buffer zone between Britain and France due to the influence of the British colony, so Thailand has protected its own industry without becoming a colony of other countries. Thailand is also said to have defended its independence in exchange for ceding the west bank of the Mekong River region in a border dispute with French Indochina. Victory Monument in Bangkok is a memorial to the Thai soldiers who were killed in the border dispute.

5. Thailand has balanced diplomatic policies

Thailand has been an active participant in ASEAN and APEC since its inception after the World War 2, and has built a strong economic bloc that will not waver in the event of an emergency while strengthening ties with neighboring countries.

Its geographic location in the center of the ASEAN region gives it the advantage of being able to control relations with China, and it also maintains good relations with the United States by facilitating relations with China.

6. Thailand is safe from natural disasters.

Compared to Japan, natural disasters in Thailand are extremely rare. Japan is one of the most earthquake-prone countries in the world, but it is no exaggeration to say that Thailand has almost no earthquakes in its capital city, Bangkok.

There is also less damage from typhoons and other natural disasters. Typhoons are more likely to cross Vietnam than the East China Sea, but they usually wane in the middle of their journey over the Vietnamese mountains. As a result, Thailand is hardly affected by typhoons, either.

Storage of gold asset.

SRCS International Co., Ltd. has partnered with a world class safe operator, and they provide you with the best possible security. It will be insured and stored securely. Your gold asset will be stored separately with individual serial number.

The facilities include

*Custodial vault equipment

- Reinforced concrete and fire-resistant concrete strength equipment

- Fingerprint authentication, facial recognition, and passport verification that is updated every 15 minutes

- Security box with dual locks with 2 or more people's identification required

- Security cameras

- Protection against 24-hour power outages, etc.

It has been managed with world class security.

Legal and Disclaimers

Site Content

This website has been prepared to provide information on the products and services offered by Glory Typhoon Co., Ltd.. (“The company”). By accessing this site, you are agreeing with the terms and conditions set out below. If you do not agree with the terms, please do not access this website.

Information on this website will be subject to change without notice. The company will endeavor to ensure information is accurate and updated, but will not be held liable for inaccuracies in the information presented. Investors are responsible to ensure that they are appropriate information about gold, taxation or other legislation that could affect them personally.

The company including affiliated companies is not liable or responsible to any person for any harm, loss, damage, proceedings, costs, claims, liabilities, damages and expenses connection with you use of this website.

No Advice

The content of this website is for informational purposes only and is not intended to provide financial, legal, accounting or tax advice, and shall not be relied upon by you in that regard.

No Solicitation

Nothing on this website constitutes a solicitation or offer by the company to buy or sell gold asset or any other products.

The company does not make any representation that the information in any linked site is accurate and will not accept any responsibility or liability for any inaccuracies in the information or content of any linked site. Any opinion or advice expressed in a linked site including our financial consultant advices, should not be construed as, and may not reflect, the opinion or advice of the company.

Disclaimer of Warranty

The site is provided on an “as is” and “as available” basis. To the maximum extent permitted by law, the company hereby disclaims any and all representations, warranties or conditions of any kind, whether expressed or implied, with respect to this website and information, products, content and other materials contained herein, including without limitation implied representations, warranties or conditions of title, non-infringement, merchantability, fitness for a particular purpose, performance, durability, availability, timeliness, accuracy, or completeness.

Security

You acknowledge and confirm that the Internet is not a secure medium where privacy can be ensured and complete security and confidentiality over the Internet is not always possible. Your confidential use of this site cannot be guaranteed, and you acknowledge that your use of the site (including personal information transmitted or uploaded to the website) may be accessible to third-parties. The company is not responsible or liable for any harm that you may suffer in connection with a breach of confidentiality or security.

Privacy

The company uses personal information provided on this site for business purposes only. Refer to our Privacy Policy for more information on our personal information practices.

The company may use "cookies" or related technology to track your usage of the site to help improve our service and your experience.

Governing Laws

The Thai laws govern the interpretation, validity and effect of these terms and any use of the site.